Blogging about real estate issues in Ventura County and Los Angeles County. Follow me by email by entering your email in the box below.

Tuesday, October 30, 2012

Case Shiller says home prices are up again!

However, they did have some long-term housing concerns. The most near-term risk the the infamous "fiscal cliff" that we face the beginning of 2013. The consensus is that the DC politicians will figure out whatever they need to do to pass the buck on this down the road to the next president, the next Congress to deal with. But, given the politics of the day, there is certainly some risk that we will hit January 1, 2013 without a solution to this large problem. If it does happen, it will have a negative impact on both the equity markets and the real estate markets.

The second risk identified as a more long-term risk is that of the Baby Boomer generation selling and downsizing their current homes. This may leave a gap of buyers at the higher end causing larger homes to come down further in value than they already have.

Zillow.com reports that Camarillo values are up 4.3% year-over-year and with national prices rising now for the last few months, I would expect that trend to continue in the short term. But, if you are thinking about selling your home in the 93010 or 93012 zip code, now may be a good time to take advantage of the window of opportunity that presents itself in this market.

In the meantime...have a great day!

Tuesday, October 23, 2012

Is it finally time to sell?

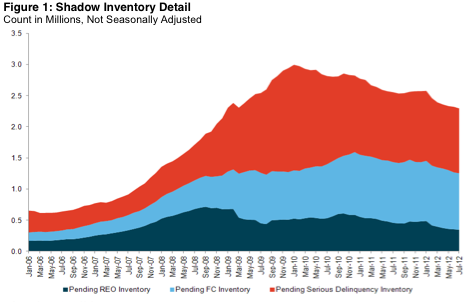

So, the shadow inventory is beginning to get dealt with. CoreLogic supported this view with an article in early October stating that the Shadow Inventory had dropped by 10% in July from where we were in the year prior. See chart to the right for details. While there is still a large number of REO Inventory to deal with, it is my belief that this inventory will trickle onto the market here in Ventura County and Camarillo rather than slamming the market with it all at once. It is certainly what I have experienced in my relationships with banks and servicing companies since that beginning of 2012. Their activity level is below what they have been used to which means that this inventory of homes really has not hit the front lines of the REO liquidation firms at this point. It will take a few years to continue to wind down out of this inventory and get back down to the normal levels we had in 2006 and prior.

Also in early October the Fed in their Beige Book report also spent some time talking about the real estate markets in a positive way by noting that "Consumer spending, which represents about 70 percent of the economy, “was generally reported to be flat to up slightly since the last report...". And that "Residential real estate proved to be a bright spot amid an otherwise pedestrian report." The Beige Book also noted that “all twelve Districts reported that existing home sales strengthened, in some cases substantially,” since the last report. It did note that one reason that values had seen an increase is due to the decline in overall residential inventory. I'm not talking about the infamous "shadow inventory" here. This is the overall number of homes on the market. This has been a key to values increasing in Ventura County and in Camarillo real estate. As I write this there are 58 single family homes on the Active market right now in Camarillo. In the last 6 months, we have sold 382 homes. This puts our inventory at less than 1 month. We will continue to see price increases until that number looks more like 3 to 4 months of homes on the market.

The chart below is from zillow.com and it outlines that prices in Camarillo were up 4.3% from the same time last year. But we do have some things to be worried about. On October 22, 2012 Lender Processing Servicers came out with their "first look" mortgage report and while they agreed that the overall foreclosure inventory continued to decline, "the delinquency rate saw a sudden mont-over-month surge. The delinquency rate, which stood at 7.4% in September, hiked up 7.72% from August. And while this number is still down from a year ago, it is certainly something to keep a close eye on. I have always said that if the economy continues at this sluggish rate, we run the risk of seeing the foreclosure rate begin to tick up again.

If you have been thinking about selling your home because of a job change or a change in the size or structure of your family or if you are one of the many who continues to struggle in this economy, there is a window of opportunity with so few homes on the market. Now may be the perfect opportunity to get your house on the market for a premium before we see the market shift again either with an increase in the interest rates or an increase again in foreclosed homes. If you have been thinking about selling your home in Camarillo or anywhere in Ventura County or the west San Fernando Valley, please call me right away for a thorough evaluation of your homes value and whether or not it is the right time for you.

Tuesday, August 28, 2012

...and the summer bubble continues!!!

So we are seeing some sustained growth which is really good news, but I wanted to put the inventory issue into perspective. In Ventura County, we have had 8,461 sales of Residential Properties in the last 12 months. As of today, we have 1,323 Residential Properties on the Active market. That is an inventory of 1.88 months. To get more specific, in Camarillo alone, we have had 932 sales of Residential Properties in the last 12 months. As of today, we only have 115 Residential Properties on the Active market. That is an inventory of only 1.5 months. That is insanely low. A natural/neutral inventory of homes where it is not having an impact on value one way or another is typically around 4 months. Someone asked me this past weekend at my Open House at 350 Commons Park Dr. in Camarillo why inventories were so low. There are a few basic reasons. First, if you own a home today, unless you are forced to sell via a distressed sale (Short Sale or Foreclosure) or a job or life relocation, then you are likely going to do everything you can to hang onto your real estate and what is still a depressed level. Second, the level of new bank-owned homes has not jumped like most have expected. This is the infamous "Shadow Inventory". Most experts are now predicting that this "Shadow Inventory" will not have a dramatic impact on values over the next few years as we continue to see the level of bank-owned homes decline.

Unless we see some major shifts in the market for Seller's I would anticipate that the inventory levels would stay low and that values would continue to rise until we get back to some normalcy as it relates to the numbers of buyers and sellers. Expect that it will be a Seller's market through the end of this year.

If you are thinking about Selling your home, now is a great time to call me to discuss strategy. If you are thinking about Buying a home, there is no time better to be represented by a Realtor who is working hard to quickly identify opportunities that fit your requirements than now. Do not try to do this on your own. I appreciate you taking the time to read this blog entry and...as always...if you know anyone who is thinking about buying or selling in the next few months, your advocacy is my greatest form of advertising. Thanks for your referral!!!

Tuesday, July 31, 2012

Summer Bubble?

[caption id="attachment_85" align="alignnone" width="532"]

Case-Shiller 20-City Index since it's inception[/caption]

Case-Shiller 20-City Index since it's inception[/caption]Now the question is...can we sustain it? Is this just due to an overall lack of inventory? I suspect so, but this leads me to the next question. When will the inventory come back?

Inventory, obviously, is a result of supply and demand. That means we either need more Sellers or fewer Buyers in order for more inventory to return. I don't see either of these happening any time soon unless prices continue to increase at this pace. If so, normal Sellers who have been waiting to move-out, move-up or move-down will finally begin to sell again. If it is just a temporary increase, I don't know why you would sell today unless you had to. Even many of the normal Sellers who are being relocated today are trying to figure out a way to hang on to the house and try to rent it so that don't have to take the financial hit of selling that asset at the bottom. Hang on, rent it, wait for the market to return. Well, now may be that time as long as we can see some continued gains in values.

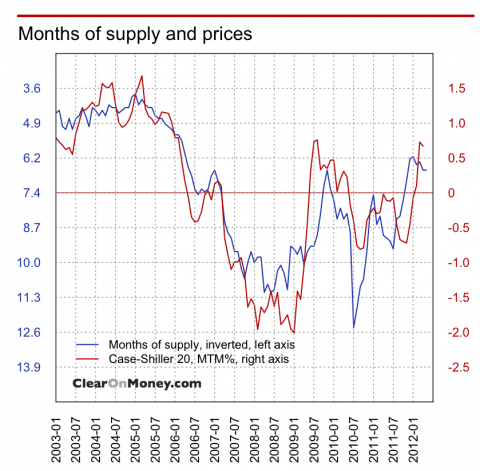

In doing this research, I came across a great chart by www.ClearOnMoney.com. They put together an amazing chart that reflects how closely home prices are tied with the level of Home Inventory. Take a look below.

This chart really shows the amazing strength between supply and demand in the real estate market. Free, open market capitalism at its best. Where buyers and sellers come together and establish a price without any market influence. As the availability of that product becomes more scare, the value increases. As it becomes more available (apparently around 8 months worth of inventory) values decline. This chart only goes through January of 2012, so we don't see the current level of increases, but certainly it shows a clear history of the two being tied together.

So, let's see if we can get some sustained growth in the real estate markets. If we can, it will be a real boost to how people are feeling about the economy.

If you are one of those who have been waiting to Sell...now may be the time. Call me so I can hear your story and give you my best advice on whether or not it's the right time for you to sell your home.

Thursday, July 26, 2012

Goldman Sachs moves Building Industry from Neutral to Attractive

A few days ago, Bloomberg ran an article outlining the fact that Goldman Sachs feels strongly that the down cylce for builders is over and has moved their recommendation for that industry from Neutral to Attractive. They have attributed low mortgage rates, a low inventory of homes, a shrinking shadow inventory and a US economy that is creating, at least, enough jobs to give this sector hope for the future. See the article below.

http://www.bloomberg.com/news/2012-07-23/goldman-sachs-sees-strong-recovery-starting-for-housing.html

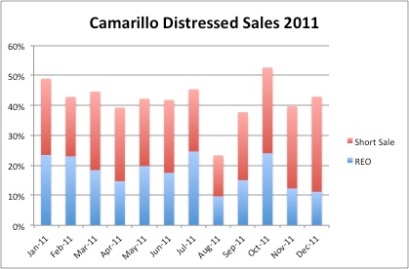

While it appears that the number of REO's has been on a steady decline, the total number of distressed sales (Short Sales and REO Sales) as a percentage of the market has remains high. See the chart below for Camarillo Distressed Sales as an example.

Tuesday, July 24, 2012

Zillow says prices have hit bottom

I'm so glad that someone was finally smart enough to let us all know that prices have finally hit bottom. See the link below to an article by zillow.com that announces the bottom has arrived. Based on research by zillow.com, in Camarillo, prices are still down .6% from a year ago today, but the data also suggests that prices are up slightly from December 2008 where the zillow home price index was at $396,000 vs June 2012 at $397,300.

http://money.msn.com/business-news/article.aspx?feed=AP&date=20120724&id=15366554

I'm certainly not smart enough to know if we have hit the bottom, but it certainly appears that recent activity this summer would suggest that values will continue to increase over the summer. The big questions are twofold. Is the economy going to hold? And, is the foreclosure shadow inventory going to force prices down? The economy is anyone's guess, but at the best it is fragile. Most of the experts I have been in contact with suggest that the shadow inventory is not as big as most predict and should not have a large impact on values going forward. So, regardless of whether or not zillow.com is right or not, I do support the theory that we are at least CLOSE to the bottom.

Thursday, July 12, 2012

Do you want the good news or the bad news?

My job as a Realtor in Camarillo and the surrounding markets of Ventura County is to educate my clients on the things that are happening in the real estate markets. Well the answer is unclear, but sometimes the best answer really is "I just don't know!" Most of the "experts" believe that we have either hit bottom or are very close to the bottom. But we still have bad news that keeps coming. The Short Sale portion of sales in Ventura County continues to rise. And, while the level of foreclosures as a percentage of the market continues to decline, we got bad news from the same Reaty Trac report outlined above that California's foreclosure rate leads the nation in June of 2012. That certainly means we have more pain to come. Having said all that, I do believe that we are beginning to get close to a "normal" market.

So, what is normal? Well, barring the Mortgage Market Meltdown in 2007 and the preceding unreasonable rise in real estate values, most real estate markets trend pretty closely to the growth of the economy and the rate of inflation. So, when things are going well in the US economy and we are seeing growth and jobs and a little inflation, we are also seeing real estate values grow at a very similar rate. Well, that rate has been out of whack for some time. Now that we are through the worst part of the housing crash and now that we are seeing signs that the economy has begun to have some slow growth, we are beginning to see the relationship between home values and US GDP growth get back into sync.

For those of you who are thinking about selling, I don't feel any different than I did a week or so ago in my previous blog. Inventory is down and there are plenty of good buyers who want to buy your home. This is causing, at least, a temporary increase in home values. If you are a buyer, then stay patient. There are no signs that the increase is going to spike values and all indications are that interest rates aren't going to jump any time soon. So, be ready. Get pre-approved so you know what it is you qualify for. Make sure your Realtor knows exactly what it is you are looking for so that when those properties hit the market, you are ready to act right away.

Have a great day today and make sure you let me know if you want to take advantage of this reduced inventory to sell your home.