A few days ago, Bloomberg ran an article outlining the fact that Goldman Sachs feels strongly that the down cylce for builders is over and has moved their recommendation for that industry from Neutral to Attractive. They have attributed low mortgage rates, a low inventory of homes, a shrinking shadow inventory and a US economy that is creating, at least, enough jobs to give this sector hope for the future. See the article below.

http://www.bloomberg.com/news/2012-07-23/goldman-sachs-sees-strong-recovery-starting-for-housing.html

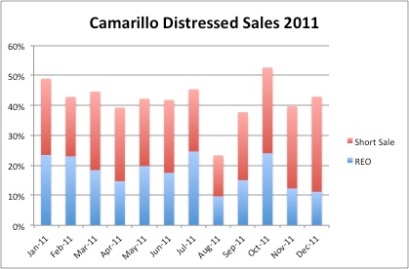

While it appears that the number of REO's has been on a steady decline, the total number of distressed sales (Short Sales and REO Sales) as a percentage of the market has remains high. See the chart below for Camarillo Distressed Sales as an example.

No comments:

Post a Comment