[caption id="attachment_85" align="alignnone" width="532"]

Case-Shiller 20-City Index since it's inception[/caption]

Case-Shiller 20-City Index since it's inception[/caption]Now the question is...can we sustain it? Is this just due to an overall lack of inventory? I suspect so, but this leads me to the next question. When will the inventory come back?

Inventory, obviously, is a result of supply and demand. That means we either need more Sellers or fewer Buyers in order for more inventory to return. I don't see either of these happening any time soon unless prices continue to increase at this pace. If so, normal Sellers who have been waiting to move-out, move-up or move-down will finally begin to sell again. If it is just a temporary increase, I don't know why you would sell today unless you had to. Even many of the normal Sellers who are being relocated today are trying to figure out a way to hang on to the house and try to rent it so that don't have to take the financial hit of selling that asset at the bottom. Hang on, rent it, wait for the market to return. Well, now may be that time as long as we can see some continued gains in values.

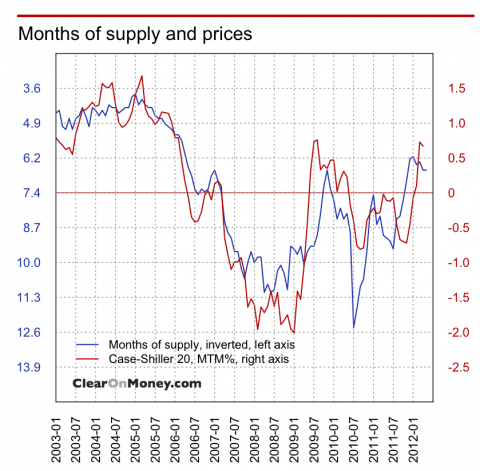

In doing this research, I came across a great chart by www.ClearOnMoney.com. They put together an amazing chart that reflects how closely home prices are tied with the level of Home Inventory. Take a look below.

This chart really shows the amazing strength between supply and demand in the real estate market. Free, open market capitalism at its best. Where buyers and sellers come together and establish a price without any market influence. As the availability of that product becomes more scare, the value increases. As it becomes more available (apparently around 8 months worth of inventory) values decline. This chart only goes through January of 2012, so we don't see the current level of increases, but certainly it shows a clear history of the two being tied together.

So, let's see if we can get some sustained growth in the real estate markets. If we can, it will be a real boost to how people are feeling about the economy.

If you are one of those who have been waiting to Sell...now may be the time. Call me so I can hear your story and give you my best advice on whether or not it's the right time for you to sell your home.

Hi John,

ReplyDeleteIf u sell and the bottom and buy someting right away, there is no financial hit, right? The worth of a home in 2007 was only the amount a buyer actually paid, not what you thought you could have earned. It's all relative only to actual cash in hand. If we r wrong, and this is a recovery, not a bubble, waiting may not be the right strategy.

Yes. You are correct. Technically, if you sell at the bottom and buy another asset in the same depressed market, you would be in the same position. But, what I am seeing is that the people that are moving, because they have to or want to, are doing everything they can to hold onto the real estate they currently own. Whether this is a recovery or bubble, if you believe that real estate values are on their way up in the near and foreseeable future, then the best strategy would be to buy as many assets as you can afford to buy to take advantage of the combination of low borrowing costs and depressed (historically speaking) prices.

ReplyDelete