I read an article today that outlined a common philosophy in real estate that when rents rise, that is an indicator that real estate values will follow suit and rise as well. I'm just not sure that is the case.

In this market, things have not been normal for some time. So, I am not sure "normal" thinking in this regard makes sense. One plus one usually means two, but in this market nothing seems as it should be. The historical philosophy has been this. If rents are increasing, most renters would begin to say to themselves "why rent at this price when we could own". It is a very logical thought process. The fallacy of it in this market is that so many renters in today's world CAN'T BUY! Many of the renters in this market now have a foreclosure on their record or they have a new Short Sale on their record or their credit is so damaged from our slow economic recovery that they can't even get an FHA loan. In addition, so many of these renters have not been able to save any money for a down payment. So ever a 3.5% FHA down payment is not achievable. So, normally, as these renters filter back into the entry level housing, it would have a trickle affect on prices throughout the cycle. But, because we are now seeing this influx filtered due to limited financing options and limited ability to save, we are not getting the full influence on the market.

In addition to this, there is also continued pressure on higher end values. So many people are NOT MOVING UP. With distressed volumes (Short Sale and Foreclosures) at 35% to 40% of the market here in places like Camarillo and Thousand Oaks and Santa Rosa Valley, the higher end markets are having trouble finding new buyers. Normal sellers would generally be looking to buy a bigger house. Now they are looking to rent. So, demand for rental housing is up significantly, hence the higher rents. Supply and demand. Right?

Lastly, as our population continues to get older, we also see more and more the influence of homeowners looking to down size. While this group doesn't necessarily want to rent, they certainly are looking to sell the big, two-story home they have owned for the last 20 years and find a smaller, single story home. Also another reason why we are not seeing values overall beginning to rise.

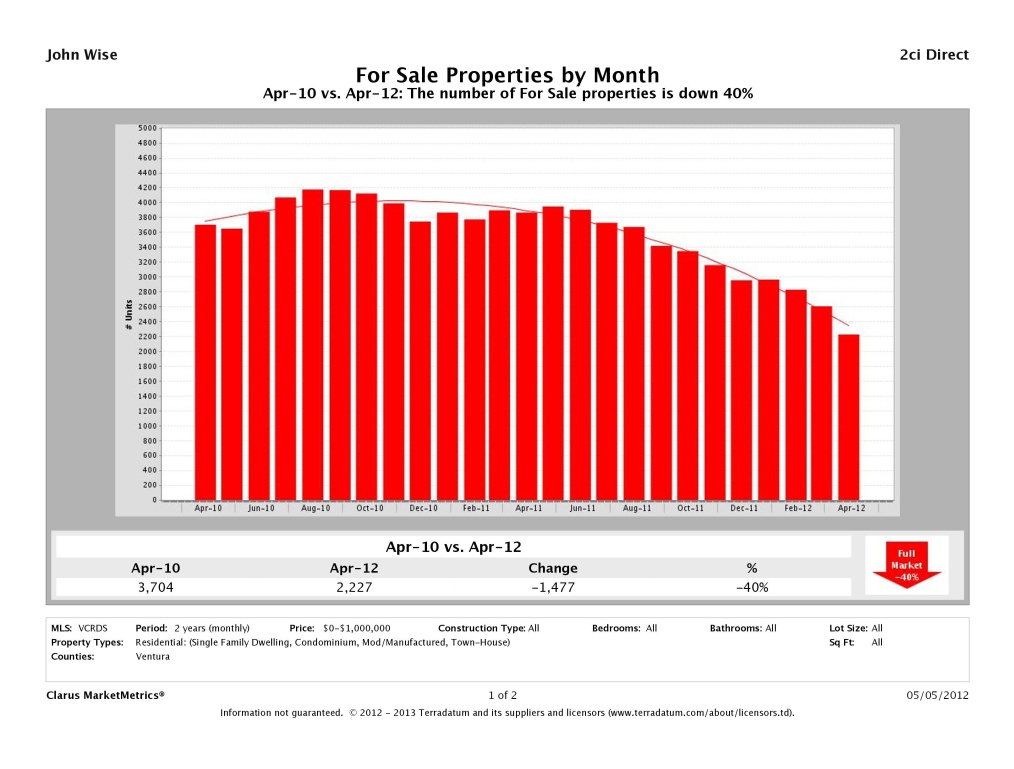

There are two bright spots to look to for continue price growth in this market. First is the lack of inventory. The chart below outlines that the inventory in Ventura County is down 40% from two years ago. This is a great sign for anyone looking to sell residential real estate in this market. It always means a higher price. Fewer choices, higher demand, higher prices.

The other positive sign for increasing values is the continued low interest rates. This has allowed the affordability to remain at an all time high. The chart below has been provided by the National Association of Realtors and it shows, on average, there has never been a better time to buy a home.

However, most economists, and more importantly, most regular Joe's assume interest rates are going to rise. It's inevitable. Especially in a country like ours where we just don't let things stay down forever. The markets will get better, the economy will grow, jobs will come back. As these things happen, interest rates will rise and the Home Affordability Index will begin to drop. The fear of interest rates rising should be an impetus to spur homeownership. And, spurring homeownership will increase values.

So whether you are a Seller or a Buyer in this market, things are looking up, but I don't think it has anything to do with rising rents. Let me know if I can help with any of your real estate needs or questions.