Blogging about real estate issues in Ventura County and Los Angeles County. Follow me by email by entering your email in the box below.

Tuesday, August 28, 2012

...and the summer bubble continues!!!

So we are seeing some sustained growth which is really good news, but I wanted to put the inventory issue into perspective. In Ventura County, we have had 8,461 sales of Residential Properties in the last 12 months. As of today, we have 1,323 Residential Properties on the Active market. That is an inventory of 1.88 months. To get more specific, in Camarillo alone, we have had 932 sales of Residential Properties in the last 12 months. As of today, we only have 115 Residential Properties on the Active market. That is an inventory of only 1.5 months. That is insanely low. A natural/neutral inventory of homes where it is not having an impact on value one way or another is typically around 4 months. Someone asked me this past weekend at my Open House at 350 Commons Park Dr. in Camarillo why inventories were so low. There are a few basic reasons. First, if you own a home today, unless you are forced to sell via a distressed sale (Short Sale or Foreclosure) or a job or life relocation, then you are likely going to do everything you can to hang onto your real estate and what is still a depressed level. Second, the level of new bank-owned homes has not jumped like most have expected. This is the infamous "Shadow Inventory". Most experts are now predicting that this "Shadow Inventory" will not have a dramatic impact on values over the next few years as we continue to see the level of bank-owned homes decline.

Unless we see some major shifts in the market for Seller's I would anticipate that the inventory levels would stay low and that values would continue to rise until we get back to some normalcy as it relates to the numbers of buyers and sellers. Expect that it will be a Seller's market through the end of this year.

If you are thinking about Selling your home, now is a great time to call me to discuss strategy. If you are thinking about Buying a home, there is no time better to be represented by a Realtor who is working hard to quickly identify opportunities that fit your requirements than now. Do not try to do this on your own. I appreciate you taking the time to read this blog entry and...as always...if you know anyone who is thinking about buying or selling in the next few months, your advocacy is my greatest form of advertising. Thanks for your referral!!!

Tuesday, July 31, 2012

Summer Bubble?

[caption id="attachment_85" align="alignnone" width="532"]

Case-Shiller 20-City Index since it's inception[/caption]

Case-Shiller 20-City Index since it's inception[/caption]Now the question is...can we sustain it? Is this just due to an overall lack of inventory? I suspect so, but this leads me to the next question. When will the inventory come back?

Inventory, obviously, is a result of supply and demand. That means we either need more Sellers or fewer Buyers in order for more inventory to return. I don't see either of these happening any time soon unless prices continue to increase at this pace. If so, normal Sellers who have been waiting to move-out, move-up or move-down will finally begin to sell again. If it is just a temporary increase, I don't know why you would sell today unless you had to. Even many of the normal Sellers who are being relocated today are trying to figure out a way to hang on to the house and try to rent it so that don't have to take the financial hit of selling that asset at the bottom. Hang on, rent it, wait for the market to return. Well, now may be that time as long as we can see some continued gains in values.

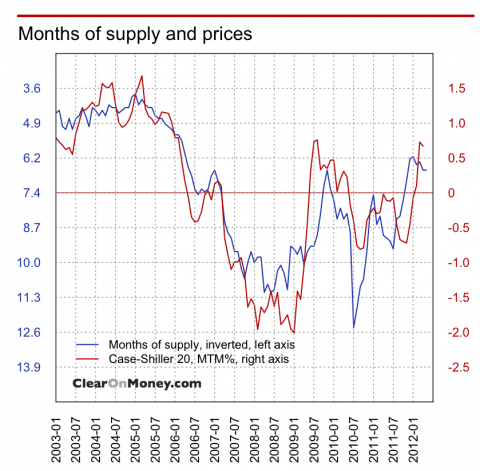

In doing this research, I came across a great chart by www.ClearOnMoney.com. They put together an amazing chart that reflects how closely home prices are tied with the level of Home Inventory. Take a look below.

This chart really shows the amazing strength between supply and demand in the real estate market. Free, open market capitalism at its best. Where buyers and sellers come together and establish a price without any market influence. As the availability of that product becomes more scare, the value increases. As it becomes more available (apparently around 8 months worth of inventory) values decline. This chart only goes through January of 2012, so we don't see the current level of increases, but certainly it shows a clear history of the two being tied together.

So, let's see if we can get some sustained growth in the real estate markets. If we can, it will be a real boost to how people are feeling about the economy.

If you are one of those who have been waiting to Sell...now may be the time. Call me so I can hear your story and give you my best advice on whether or not it's the right time for you to sell your home.

Thursday, July 26, 2012

Goldman Sachs moves Building Industry from Neutral to Attractive

A few days ago, Bloomberg ran an article outlining the fact that Goldman Sachs feels strongly that the down cylce for builders is over and has moved their recommendation for that industry from Neutral to Attractive. They have attributed low mortgage rates, a low inventory of homes, a shrinking shadow inventory and a US economy that is creating, at least, enough jobs to give this sector hope for the future. See the article below.

http://www.bloomberg.com/news/2012-07-23/goldman-sachs-sees-strong-recovery-starting-for-housing.html

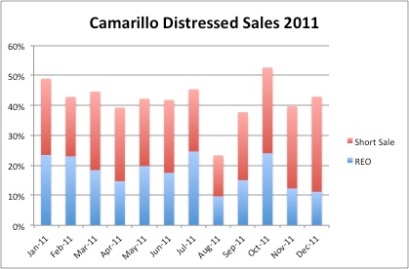

While it appears that the number of REO's has been on a steady decline, the total number of distressed sales (Short Sales and REO Sales) as a percentage of the market has remains high. See the chart below for Camarillo Distressed Sales as an example.

Tuesday, July 24, 2012

Zillow says prices have hit bottom

I'm so glad that someone was finally smart enough to let us all know that prices have finally hit bottom. See the link below to an article by zillow.com that announces the bottom has arrived. Based on research by zillow.com, in Camarillo, prices are still down .6% from a year ago today, but the data also suggests that prices are up slightly from December 2008 where the zillow home price index was at $396,000 vs June 2012 at $397,300.

http://money.msn.com/business-news/article.aspx?feed=AP&date=20120724&id=15366554

I'm certainly not smart enough to know if we have hit the bottom, but it certainly appears that recent activity this summer would suggest that values will continue to increase over the summer. The big questions are twofold. Is the economy going to hold? And, is the foreclosure shadow inventory going to force prices down? The economy is anyone's guess, but at the best it is fragile. Most of the experts I have been in contact with suggest that the shadow inventory is not as big as most predict and should not have a large impact on values going forward. So, regardless of whether or not zillow.com is right or not, I do support the theory that we are at least CLOSE to the bottom.

Thursday, July 12, 2012

Do you want the good news or the bad news?

My job as a Realtor in Camarillo and the surrounding markets of Ventura County is to educate my clients on the things that are happening in the real estate markets. Well the answer is unclear, but sometimes the best answer really is "I just don't know!" Most of the "experts" believe that we have either hit bottom or are very close to the bottom. But we still have bad news that keeps coming. The Short Sale portion of sales in Ventura County continues to rise. And, while the level of foreclosures as a percentage of the market continues to decline, we got bad news from the same Reaty Trac report outlined above that California's foreclosure rate leads the nation in June of 2012. That certainly means we have more pain to come. Having said all that, I do believe that we are beginning to get close to a "normal" market.

So, what is normal? Well, barring the Mortgage Market Meltdown in 2007 and the preceding unreasonable rise in real estate values, most real estate markets trend pretty closely to the growth of the economy and the rate of inflation. So, when things are going well in the US economy and we are seeing growth and jobs and a little inflation, we are also seeing real estate values grow at a very similar rate. Well, that rate has been out of whack for some time. Now that we are through the worst part of the housing crash and now that we are seeing signs that the economy has begun to have some slow growth, we are beginning to see the relationship between home values and US GDP growth get back into sync.

For those of you who are thinking about selling, I don't feel any different than I did a week or so ago in my previous blog. Inventory is down and there are plenty of good buyers who want to buy your home. This is causing, at least, a temporary increase in home values. If you are a buyer, then stay patient. There are no signs that the increase is going to spike values and all indications are that interest rates aren't going to jump any time soon. So, be ready. Get pre-approved so you know what it is you qualify for. Make sure your Realtor knows exactly what it is you are looking for so that when those properties hit the market, you are ready to act right away.

Have a great day today and make sure you let me know if you want to take advantage of this reduced inventory to sell your home.

Tuesday, July 3, 2012

Do people really live this way?

A few days ago I was assigned two new bank-owned homes to sell for two different banks. Both properties were located in Camarillo and both left me walking away saying to myself..."how do people live this way?". Below are pictures from both REO Homes in Camarillo.

The picture above is not just wet marks on the carpet. It is dog-urine-soaked carpet!!! Literally! The entire upstairs was just like this. You could barely breathe inside the home. I got sick from just having to walk through and take the pictures.

The picture above is similar. The tenant had just vacated this home a few days before this picture and the entire home was filled with dog feces and dog urine. Now there are the obvious problems for the dog and this being an inhumane way to keep a pet, but I just can't figure out what causes someone to think that this is an acceptable way to live.

It is normal for most homeowners, once they have begun to miss payments and realize that they may not own the home for much longer, to stop maintaining things. They stop watering the grass! They stop mowing the lawn! They don't pull the weeds! They down replace light bulbs! But these examples of distressed homeowners goes beyond what is normal. There are solutions before you get to this point. A Short Sale in Camarillo would have stopped most of this destruction from happening. Not only that, but the Short Sale can help to not devastate your credit and ability to borrow at competitive rates in the near future.

It is always my pleasure to sell homes for banks in situations like these because I know I am improving the community. Many banks have begun to rehab properties before they come on the market and this is another reason why values have begun the process of improvement. A few years ago, the banks would have just tried to sell these assets "as-is". Find a cash buyer who would buy them on the cheap, rehab them and then flip it. But that "on the cheap" purchase was dragging values down. Now, the "on the cheap" value doesn't exist because the banks are taking the time and resources to allow these properties to be sold on the open market. The banks make more money! The community makes more money because the bank is using local contractors to do the rehab! And, the neighborhood values are improving because they are able to sell these properties at higher values.

Don't let your home get to this point. Use the process of the Short Sale to get out of your situation.

Saturday, May 5, 2012

Rent Prices as an Indicator of Rising Prices?

I read an article today that outlined a common philosophy in real estate that when rents rise, that is an indicator that real estate values will follow suit and rise as well. I'm just not sure that is the case.

In this market, things have not been normal for some time. So, I am not sure "normal" thinking in this regard makes sense. One plus one usually means two, but in this market nothing seems as it should be. The historical philosophy has been this. If rents are increasing, most renters would begin to say to themselves "why rent at this price when we could own". It is a very logical thought process. The fallacy of it in this market is that so many renters in today's world CAN'T BUY! Many of the renters in this market now have a foreclosure on their record or they have a new Short Sale on their record or their credit is so damaged from our slow economic recovery that they can't even get an FHA loan. In addition, so many of these renters have not been able to save any money for a down payment. So ever a 3.5% FHA down payment is not achievable. So, normally, as these renters filter back into the entry level housing, it would have a trickle affect on prices throughout the cycle. But, because we are now seeing this influx filtered due to limited financing options and limited ability to save, we are not getting the full influence on the market.

In addition to this, there is also continued pressure on higher end values. So many people are NOT MOVING UP. With distressed volumes (Short Sale and Foreclosures) at 35% to 40% of the market here in places like Camarillo and Thousand Oaks and Santa Rosa Valley, the higher end markets are having trouble finding new buyers. Normal sellers would generally be looking to buy a bigger house. Now they are looking to rent. So, demand for rental housing is up significantly, hence the higher rents. Supply and demand. Right?

Lastly, as our population continues to get older, we also see more and more the influence of homeowners looking to down size. While this group doesn't necessarily want to rent, they certainly are looking to sell the big, two-story home they have owned for the last 20 years and find a smaller, single story home. Also another reason why we are not seeing values overall beginning to rise.

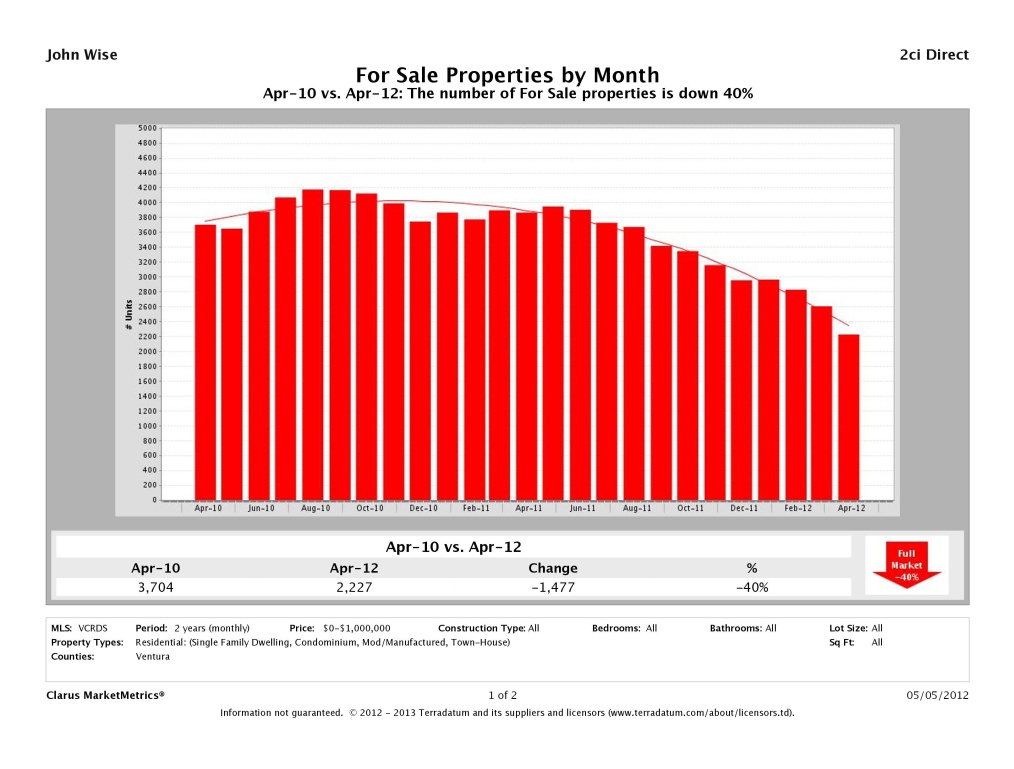

There are two bright spots to look to for continue price growth in this market. First is the lack of inventory. The chart below outlines that the inventory in Ventura County is down 40% from two years ago. This is a great sign for anyone looking to sell residential real estate in this market. It always means a higher price. Fewer choices, higher demand, higher prices.

The other positive sign for increasing values is the continued low interest rates. This has allowed the affordability to remain at an all time high. The chart below has been provided by the National Association of Realtors and it shows, on average, there has never been a better time to buy a home.

However, most economists, and more importantly, most regular Joe's assume interest rates are going to rise. It's inevitable. Especially in a country like ours where we just don't let things stay down forever. The markets will get better, the economy will grow, jobs will come back. As these things happen, interest rates will rise and the Home Affordability Index will begin to drop. The fear of interest rates rising should be an impetus to spur homeownership. And, spurring homeownership will increase values.

So whether you are a Seller or a Buyer in this market, things are looking up, but I don't think it has anything to do with rising rents. Let me know if I can help with any of your real estate needs or questions.