Blogging about real estate issues in Ventura County and Los Angeles County. Follow me by email by entering your email in the box below.

Wednesday, April 10, 2013

April 10 - 30 Sec Daily Market Update

The National Association of Realtors is reporting that the 71% of the lenders they surveyed believe that the recent trends of increasing real estate values is a sustainable trend into the near future. It's always good with a majority of the lenders believe that values will be improving. Usually that means they will follow suit with lowering their underwriting standards.

Tuesday, April 9, 2013

April 9 - 30 Sec. Real Estate Market Update

Housing inventories beginning to rise! Good sign for buyers this summer and a sign that we should see prices stabilize in the near future.

Friday, April 5, 2013

30 Sec Real Estate Market Update - April 5

For those of you who are frustrated trying to buy a house, make sure you get pre-approved with a lender who you trust and who can respond quickly. Make sure you submit an offer with a pre-approval that matches or exceeds your offer.

Wednesday, April 3, 2013

30 Second Real Estate Market Update - April 3

Frustrated buyer tip #3. Don't ask for closing costs in this market. The seller will just view it as a lower asking price.

John Wise

Camarillo Inventory...should bring more Sellers soon!

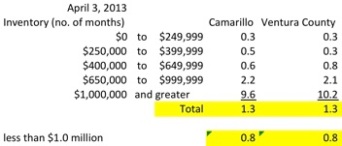

With the type of price increases we are seeing in the Camarillo area as well as the surrounding markets in the Conejo Valley and great Ventura County, it is bound to bring more Sellers to the market. The inventory levels are still very low as you will see from the chart below.

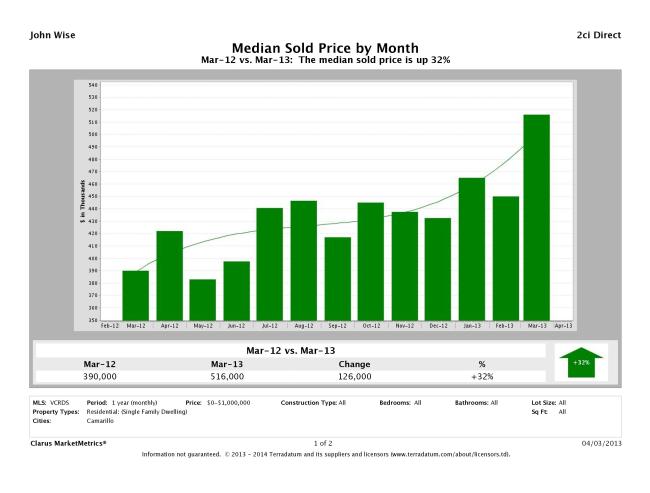

This chart shows Active Inventory based on the MLS compared to sales for the last 12 months of Single Family homes. Below $1,000,000 there is less than 1 month of inventory. This bodes well for Sellers of Camarillo property, but for some reason, many have not taken advantage of this opportunity. As we see more and more homes climb their way back into an equity position, we are sure to see more Sellers in this market. Once people realize that values have spiked again, you will have more homeowners begin to take advantage of the market shift back to a Sellers market. Take a look at the Median prices in Camarillo over the last 12 months.

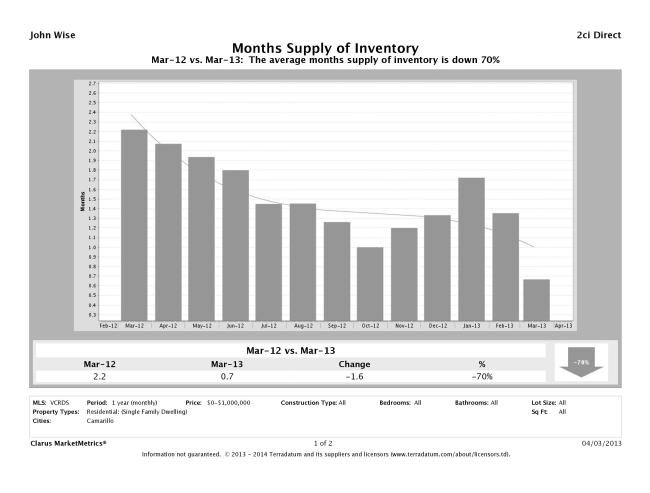

Part of the reason for the price increases is the fact that few units are being sold. As you will see from the next chart below, over the last 3 months, the number of sales from $1,000,000 and below is on the decline. Some of this has to do with the lack of inventory, but I would also suggest that as prices continue to increase, the investor demand will begin, and has already, begun to wane.

Don't wait for this window to close if you are thinking about selling your home in the next 6 months, call me right away to take advantage of this market dynamics.

John Wise, Broker/Owner, 2ci Direct Real Estate Services

Tuesday, April 2, 2013

30 Sec Real Estate Market Update - April 2, 2013

30 Sec Real Estate Market Update - April 2, 2013. Make sure your offer price isn't too low. This is a Seller's market and you need to stay aggressive if you want to buy a house.

Investor demand driving values up...but not for long!

The benefits of these rising prices is obvious and, for the most part, good for everyone. The biggest benefit is that it is making all the current homeowners feel better about their own financial position. This feeling of wealth is showing up in Consumer Spending and in people's overall mindset about the future growth of our economy. This confidence has led to record highs on the stock market and has led millions of homeowners out from their negative equity position into the positive territory again. However, what we don't want is another bubble in the real estate markets. Its been about 7 years since the real estate markets began to crash so we are finally beginning to see a turnaround and, again, growth is good...a bubble is bad. Because we all know what happens to bubbles eventually.

So what are the risks? First, Case-Shiller says that investor demand has made up close to one-third of all home sales in this recent recovery. They have come into the market for the same reason most investors come into any market. Returns and growth. When values were still low, and rents were still rising, it was an investor no-brainer. Buy it at the right price, rent it and achieve returns that out-perform the rest of the current market. In addition, if the market continues to rise, you also get the benefit of being able to sell the asset at a higher price at some point in the future. Eventually this will begin to fade and we have already begun to see signs that this part of the recovery is beginning to fade. With values up in Camarillo 20% from a year ago and rental rates beginning to stabilize, the investor returns have begun to tighten. So, most predict that this portion of the market will begin to slow down quite a bit in markets like this one where prices have risen at a level higher than the rest of the country.

The second risk is rising interest rates. The Fed has committed to keeping rates low through next summer, but if the economy catches any momentum, don't be surprised if these rates start to go up sooner rather than later. We have already seen a small increase in mortgage rates even without the Fed making any changes. As the economy finds some traction, mortgage rates are bound to go up. However, most don't project any spike in rates, but more of a normal up tick as the overall economy improves.

The third risk to the markets has to do with problems overseas. We have nuclear threats in North Korea and in Iran. The Middle East still appears to be a time bomb. But, to be honest, I'm just not smart enough to know how any of that might affect our local real estate values. I just know that if we enter World War III because one of the countries decides to drop a bomb, it won't be helpful to anyone.

Now the good news. Obviously, for current homeowners, the increase in values is refreshing. After years and years of getting bad news about your real estate, we finally have some reasons to celebrate. Second, it appears that lending standards may finally be loosening. Lenders are increasingly approving lower down payment loans and the larger government-sponsorded entities, FNMA and FHLMC are now buying more of these loans. You still have to provide your life history to get the loans, but at least we are beginning to see a thawing of residential credit in the US. Now, what we don't want is to go back to the unreasonable standards that got us into this mess, but certainly a reasonable shift is welcomed. In addition, begin to worry again if the President starts talking about trying to figure out a way for everyone to own a home.

Second piece of good news that we had this week is a report by the Pulte Group that "nearly two-thirds of millennials expressed an increased interest in buying" a home. During the most recent down cycle, this group really had no reason to invest in this market. But now that they have seen values improving the Pulte Group study shows that "65 percent of renters between ages 18 to 34 plan to buy a home in the near future". This is probably the best news I have heard in a long time because when you add into this market the normal first time homebuyer, it means we should be back on our way to some normalcy. First time home buyers buying non-distressed homes with equity means we are likely to have first time move up buyers buying their second home. And when that happens, then we begin to see growth again all the way up to the luxury home market.

Anyway, that's enough information for one blog post. I hope it was good and useful information. If you are curious as to whether or not you have more equity than you realized, or you are thinking about selling your home in this market, I would be honored to talk to you about it. I look forward to hearing from you.