New reports are out this morning from the people at foreclosure.com. They are stating that in October of 2012, the foreclosure cancellations in California were up 62.1% from the month prior and they think that the main source of the increase is the new law that will go into affect in January called the California Homeowners Bill of Rights. One of the primary features of this law is to prevent "dual-tracking". Basically what that means is that if you are under consideration for a loan modification or have submitted a request for a Short Sale, your lender has to CANCEL your foreclosure proceedings. In the past, the lenders have been able to process your foreclosure at the same time your are in process for a Short Sale or Loan Modification. That way, if you were denied for either, the bank was still in the position to move forward and complete the foreclosure right away.

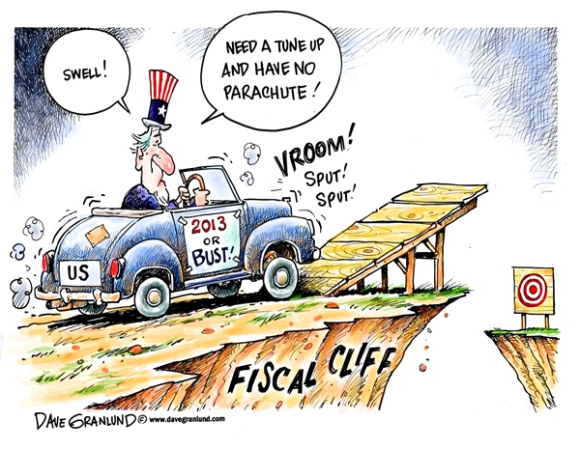

While this is a great new law for homeowners, it will have a continue negative affect on the amount of inventory that is available in California. As I have said in my last few blog posts, the level of homes available to buy in California is down to almost record levels and that will have a dramatic impact on values. When demand is high (and it is high) and inventory is low, it almost always means that values will be on the rise. The National Association of Realtors is projecting that, assuming we avoid the infamous "fiscal cliff", that real estate values will rise nationally by 5.1% next year. If the inventory levels remain at their existing levels, I believe values in California, Ventura County and Camarillo and surrounding communities will rise more than that.

If you think that you may have to, or want to sell in the next 6 months, the market should be support higher values than you thought were achievable 6 months ago.

One other thing to note today that we certainly want to keep our eye on is the delinquency data. LPS, one of the country's largest servicing companies is stating that foreclosure starts in September suddenly spiked by 7.7% from the month earlier. They are stating that most of the increase came in homeowners who are now 30 days late on their mortgage. This "new" activity is troubling and it points to continued weakness in the overall economy.

Please let me know if you know anyone who is thinking about buying or selling in the next 6 months. It is the best time ever to use a Realtor who knows the market and understands the foreclosure and Short Sale process.

No comments:

Post a Comment